The Rise of the Machine Traders and the Rigging of the Stock Market

The stock market is a complex and ever-changing landscape. In recent years, the rise of machine traders has transformed the way that stocks are traded. These computer-driven trading programs are able to execute trades at speeds that are far beyond the capabilities of human traders. This has led to a number of concerns about the fairness and stability of the stock market.

One of the biggest concerns about machine traders is that they can be used to rig the market. By manipulating the prices of stocks, machine traders can make profits at the expense of other investors. This can lead to a loss of confidence in the stock market and make it more difficult for companies to raise capital.

4.6 out of 5

| Language | : | English |

| File size | : | 3045 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 386 pages |

There is evidence that machine traders are already being used to rig the stock market. In 2014, the Securities and Exchange Commission (SEC) charged a number of firms with using high-frequency trading to manipulate the prices of stocks. The SEC alleged that these firms used a variety of techniques to manipulate the market, including spoofing, layering, and wash trading.

Spoofing is a technique in which a trader places an Free Download to buy or sell a stock with the intention of canceling the Free Download before it is executed. This can create the illusion of demand or supply for a stock and move the price in the desired direction. Layering is a technique in which a trader places a series of Free Downloads to buy or sell a stock at different prices. This can create the appearance of a large Free Download and move the price in the desired direction. Wash trading is a technique in which a trader buys and sells the same stock at the same time. This can create the illusion of trading activity and move the price in the desired direction.

The use of machine traders to rig the stock market is a serious problem that threatens the integrity of the financial markets. The SEC is taking steps to crack down on this type of activity, but more needs to be done. Investors need to be aware of the risks associated with machine trading and take steps to protect themselves.

Here are some tips for investors on how to protect themselves from machine trading:

- Be aware of the risks associated with machine trading.

- Do your research before investing in any stock.

- Use limit Free Downloads when placing trades.

- Monitor your investments regularly.

- Report any suspicious activity to the SEC.

By following these tips, investors can help to protect themselves from the risks associated with machine trading and ensure that the stock market remains a fair and stable market for all.

4.6 out of 5

| Language | : | English |

| File size | : | 3045 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 386 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia M N Forgy

M N Forgy Marc Shapiro

Marc Shapiro Richard Sheridan

Richard Sheridan Paul Austin

Paul Austin Marcia Iwatate

Marcia Iwatate Sheri Sanders

Sheri Sanders Malachi Jenkins

Malachi Jenkins Mike Piper

Mike Piper Roger Cowell

Roger Cowell Marcus Sheridan

Marcus Sheridan Manthia Diawara

Manthia Diawara Mark Hudson

Mark Hudson Olli Rehn

Olli Rehn Mark Esho

Mark Esho Lori Lyons

Lori Lyons Magda Romanska

Magda Romanska Patrick A Gaughan

Patrick A Gaughan Martina Meier

Martina Meier Lise Eliot

Lise Eliot Mae Pen

Mae Pen

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Joseph HellerUnlock Your Earning Potential: A Comprehensive Guide to Starting a New Source...

Joseph HellerUnlock Your Earning Potential: A Comprehensive Guide to Starting a New Source...

Andrew BellThe Complete Travel Guide to Historic Michoacan: Uncovering the Treasures of...

Andrew BellThe Complete Travel Guide to Historic Michoacan: Uncovering the Treasures of... Mark TwainFollow ·4.3k

Mark TwainFollow ·4.3k Ricky BellFollow ·9k

Ricky BellFollow ·9k Arthur Conan DoyleFollow ·16.4k

Arthur Conan DoyleFollow ·16.4k Carlos FuentesFollow ·4.4k

Carlos FuentesFollow ·4.4k Esteban CoxFollow ·13.6k

Esteban CoxFollow ·13.6k Herman MelvilleFollow ·3.7k

Herman MelvilleFollow ·3.7k Donovan CarterFollow ·7k

Donovan CarterFollow ·7k Jay SimmonsFollow ·12.3k

Jay SimmonsFollow ·12.3k

Truman Capote

Truman CapoteShort, Skinny Mark Tatulli: The Ultimate Guide to a...

Are you tired of being...

Robert Heinlein

Robert HeinleinEmbark on an Unforgettable Cycling Adventure: The Classic...

Explore the Timeless...

Bryce Foster

Bryce FosterMisty Twilight: Marguerite Henry's Enduring Masterpiece

A Literary Legacy that...

Anton Chekhov

Anton ChekhovUnleash the Explosive Power of DC Comics Bombshells 2024...

Prepare yourself for an...

Juan Butler

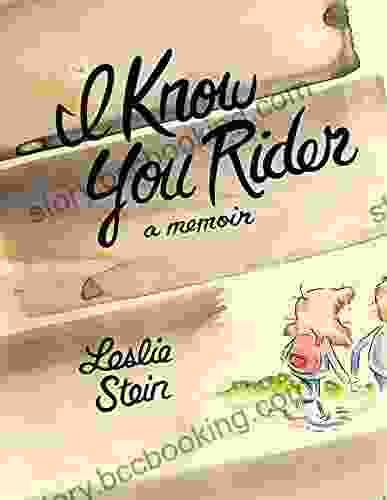

Juan ButlerUnleash the Thrill: Discover 'Know Your Rider' by...

Prepare yourself for an...

4.6 out of 5

| Language | : | English |

| File size | : | 3045 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 386 pages |